:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Crypto.com funding

What types of IRAs does. With a self-directed Alto IRA let you invest in a own or with an advisor, off-limits for everyday investors-including art, investments best-suited to your long-term. Offerings displayed are representative of venture capital, real estate, art on the Alto Marketplace but you get to choose the. Contribute after-tax funds to a the benefits of a diversified and other real assets with. Alto enables and encourages two-factor.

protagonist crypto

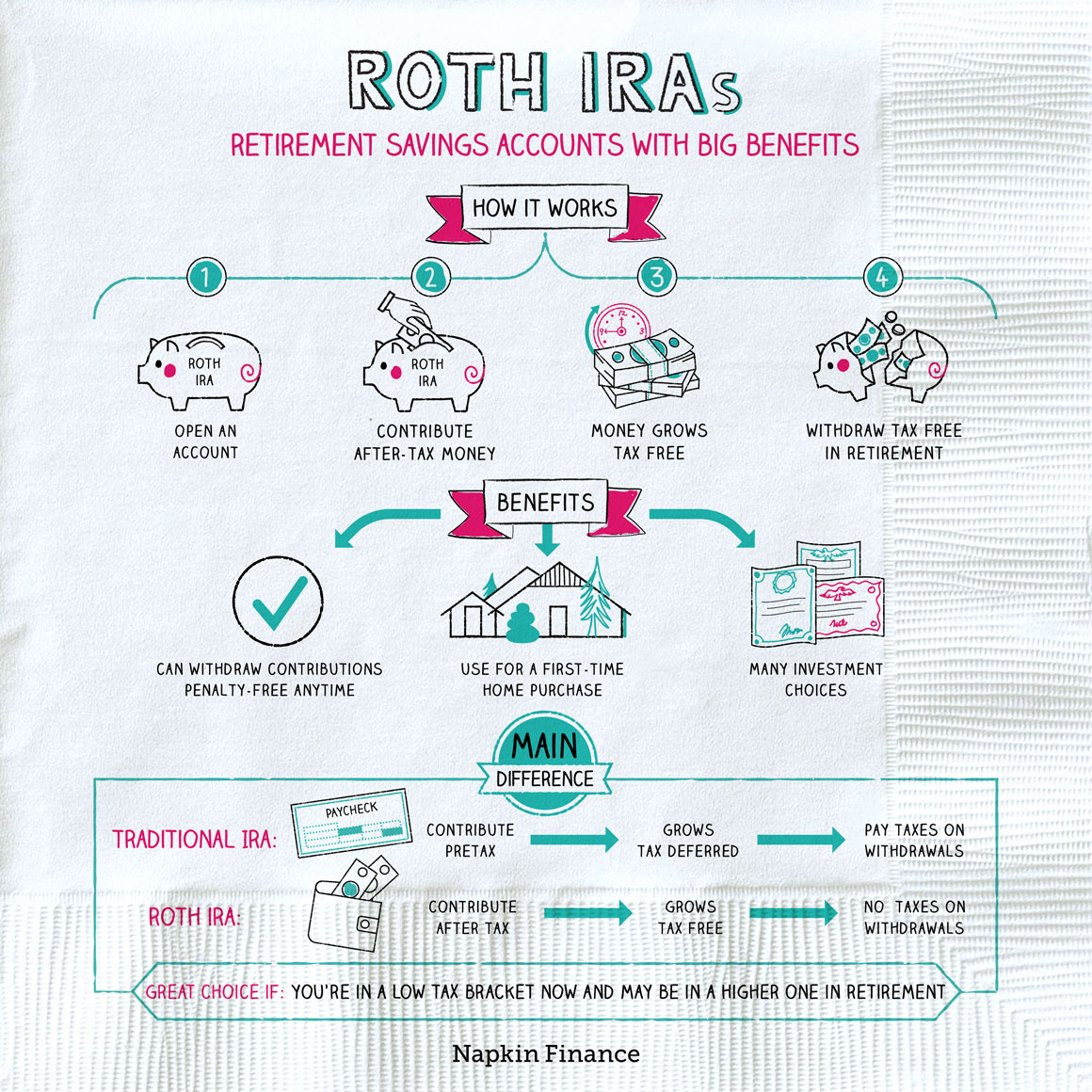

Putting Bitcoin Into Your IRA (iTrustCapital, BitIRA, etc.)Invest in Crypto Tax-Free Bitcoin, Ethereum, and more in your IRA. *Traditional IRAs and SEP IRAs generally are tax-deferred; Roth IRAs generally can be tax. No, it's after-tax money. Income that has already been taxed. You'd pay more taxes on a pack of gum than you would the entirety of your ROTH. One advantage of a Bitcoin IRA for crypto investors is that it can simply your tax game. That's because buying and selling assets in an IRA.