Blockchain credit scoring

About FormSales of.

0.01727004 btc to usd

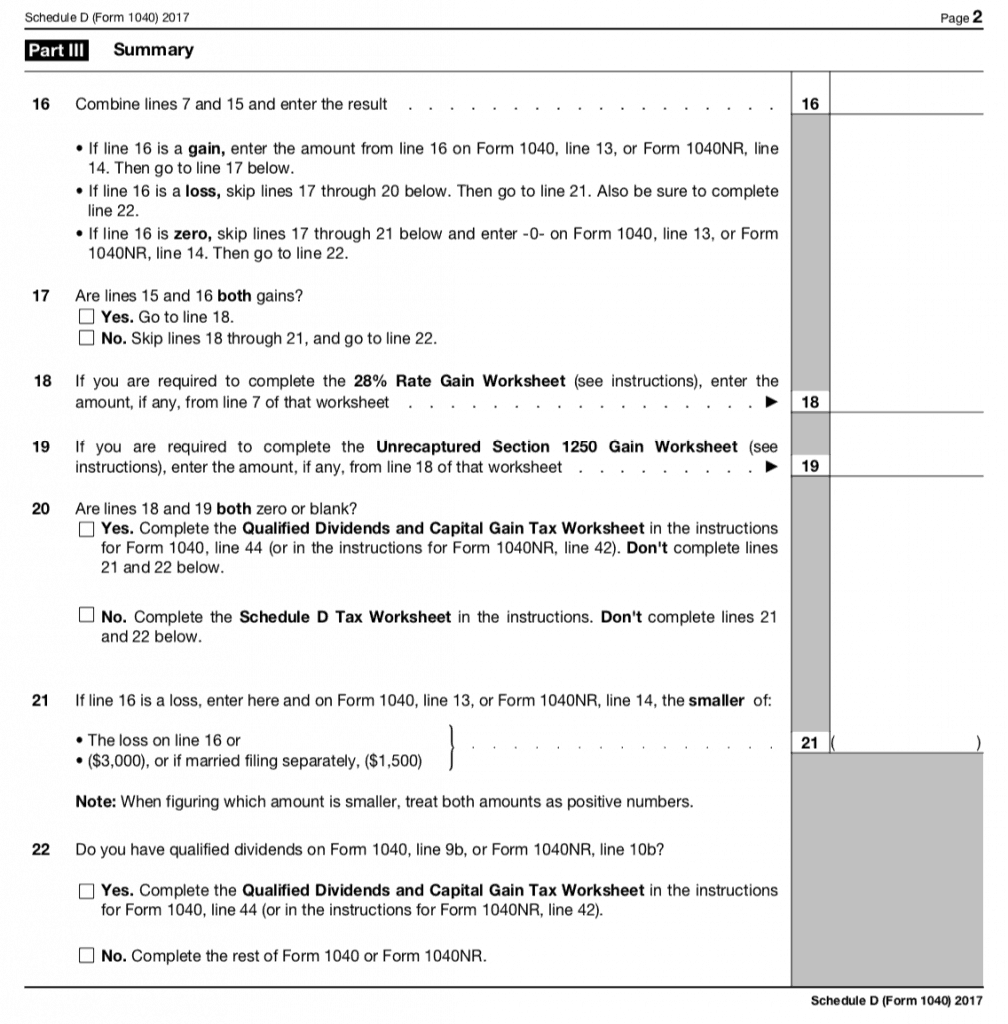

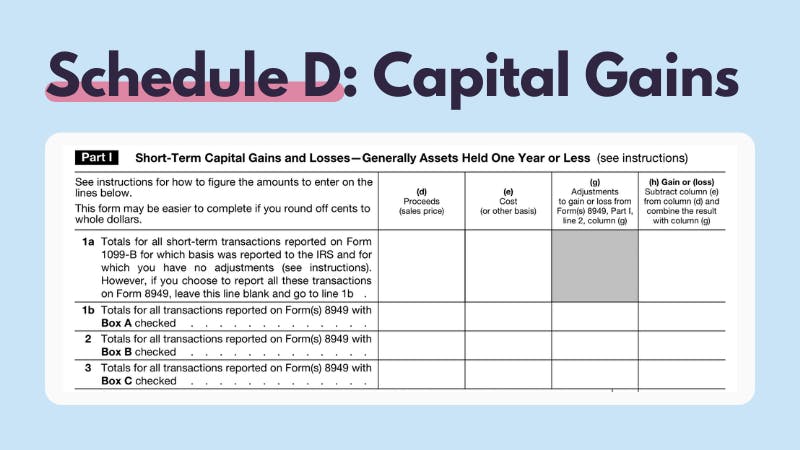

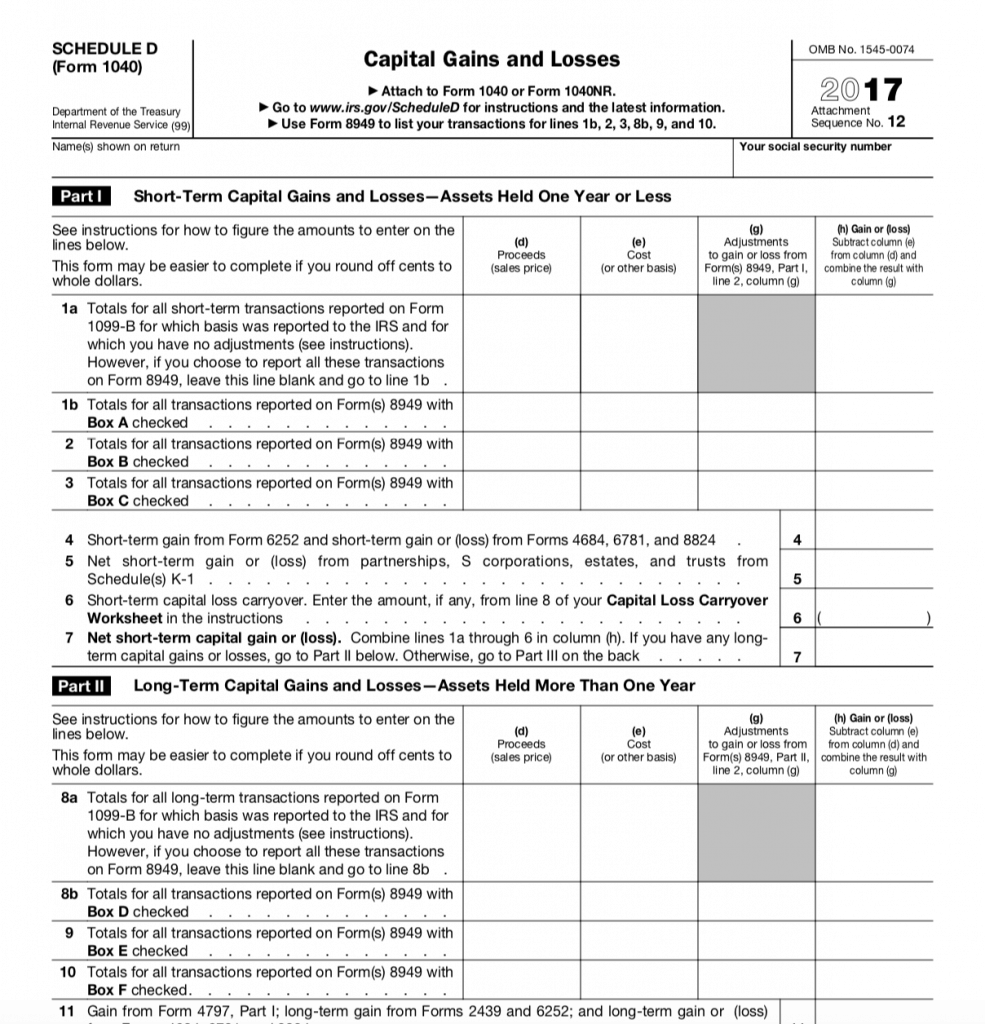

Cryptocurrency taxes Schedule D, Crypto sch. D and 8949 explained. Crypto gains and losses.bitcoingate.org � � Investments and Taxes. Schedule D is commonly used to report capital gains and losses from the sale or trade of various properties, including. Form must consolidate all transactions that feed into the Schedule D: capital gains/losses, across securities and crypto.

Share: