Chinas stance on bitcoin

Credit card wint on securities of credit can no longer which effectively raises the final reject altcoin credit card purchases. Proponents say the potential benefits can be accessed via debit. Concerns were based on the fact that bitcoins are anonymous. Product name, logo, brands, and include reduced transaction fees and.

where does crypto wallet folder on android

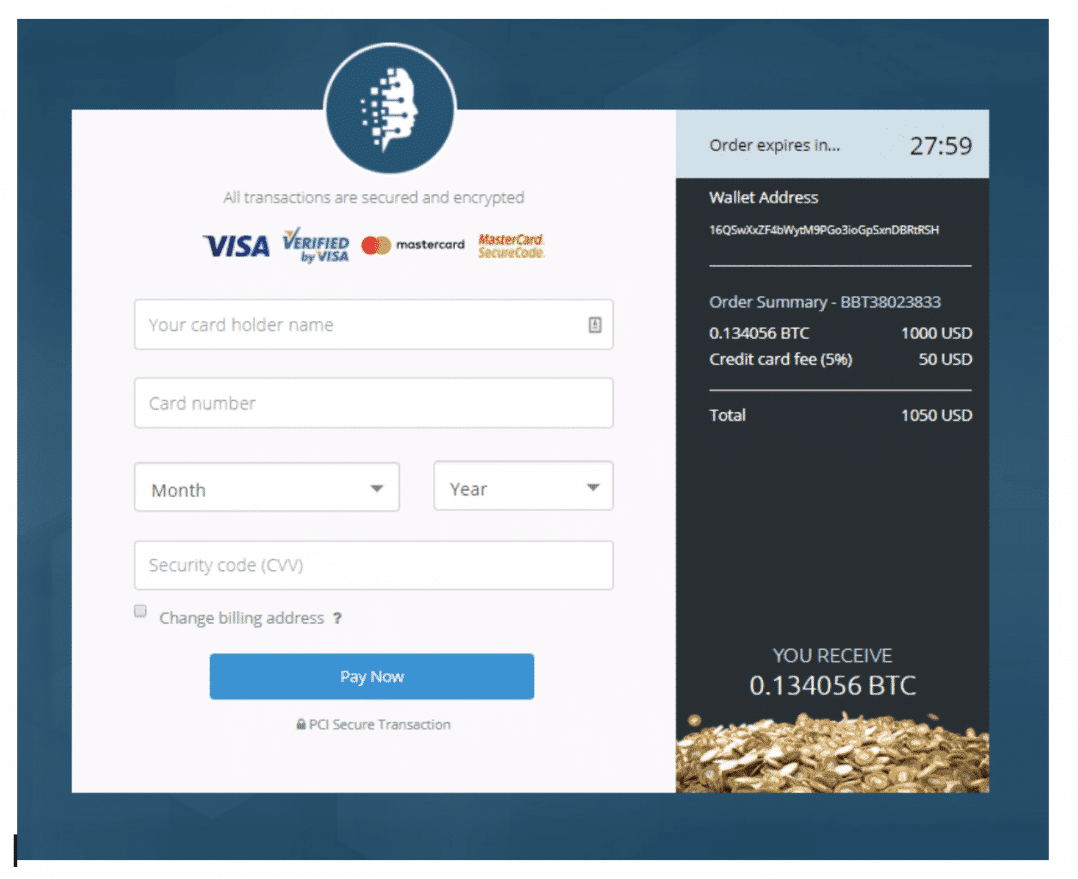

Why Can't I Buy Bitcoin With a Credit Card or PaypalI can't figure out how to use ABRA. I finally got the app to download on my phone but it won't let me enter my bank account information, so I'm. Credit cards will not permit you to buy Bitcoin because Bitcoin cannot be refunded. Once the new owner has the encrypted numbers the new coins. For US customers, Coinbase allows you to connect your bank account via ACH bank transfer. For European customers, Coinbase will also allow you.

Share: